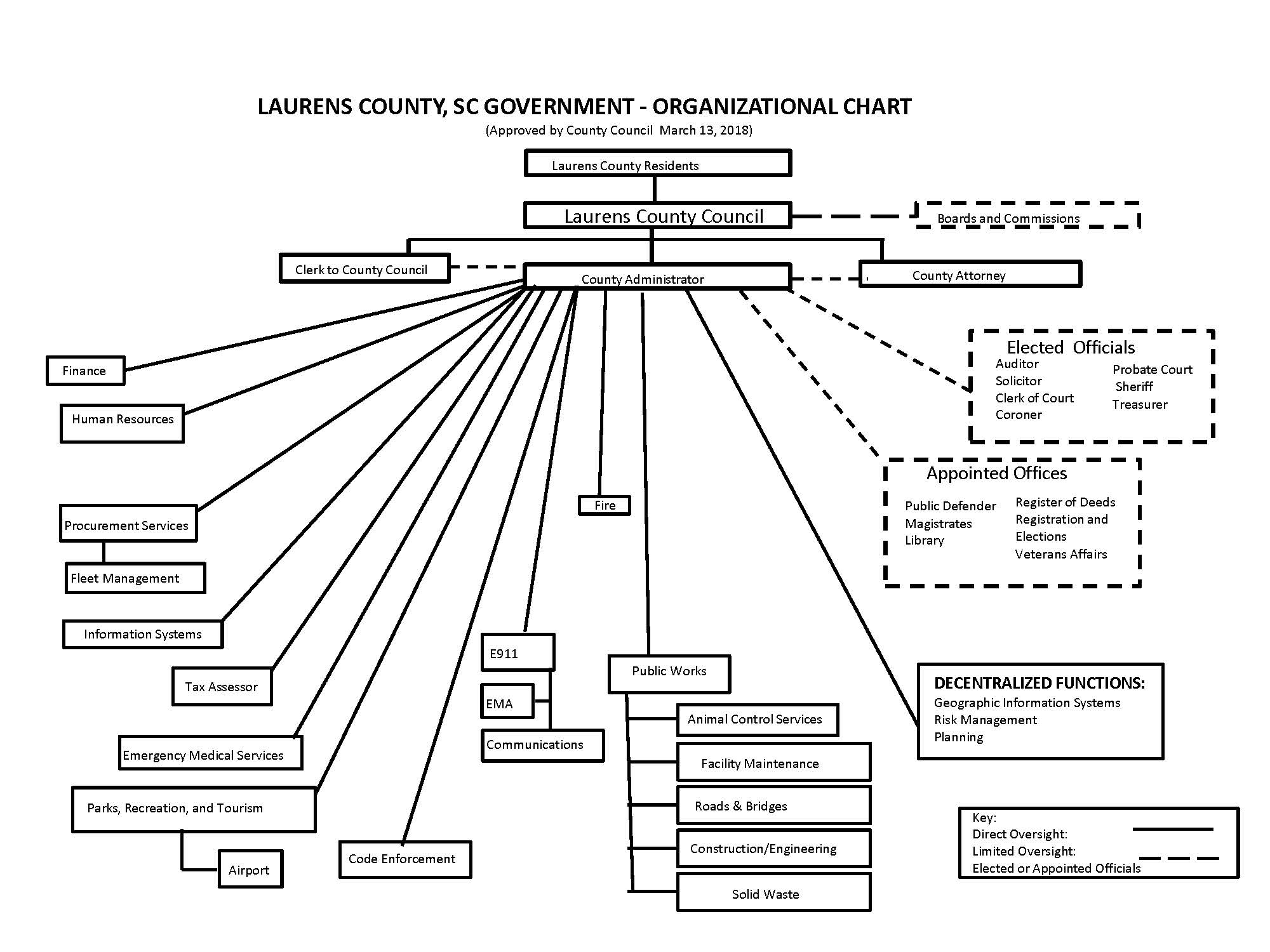

Laurens County Tax Office

All returned checks due to insufficient funds closed accounts incorrect routing numbers or any other related bank account issue will be charged.

Laurens county tax office. The primary function of the assessor s office is to identify map classify and assess residential commercial agricultural and vacant real property within laurens county for ad valorem tax purposes within the guidelines of south carolina code of laws south carolina department of revenue regulations and laurens county ordinances. Box 2011 117 e jackson street dublin ga 31040. The goal of the laurens county assessors office is to provide the people of laurens county with a web site that is easy to use.

The laurens county assessor s office and the laurens county treasurer s office disclaims any responsibility or liability for any direct or indirect damages resulting from the use of this data system. Our staff is separated into two departments. Min 50 f 68 46 f 70 46 f.

The information contained herein reflects the values established in the most current published tax digest. Property taxes if you need to change your address please contact the laurens county assessor s office at 864 984 6546. If you see sold at tax sale tax sale please contact our office at 864 984 4742.

The tax commissioner s office is established by the georgia constitution and is responsible for every phase of collection and disbursing ad valorem property taxes. You can search our site for a wealth of information on any property in laurens county. Vehicle taxes if you need to change your address prior to paying your bill contact the laurens county auditor s office at 864 984 2535.

The laurens county treasurer and tax collector s office is part of the laurens county finance department that encompasses all.