Lexington County Tax Office

Helpful information and user links if vehicle has been sold contact the lexington county auditor at 803 785 8181.

Lexington county tax office. Allow up to 15 business days from the payment date to ensure bank verifications of sufficient funds for check payments. Lexington county implemented a countywide reassessment in 2015. For online vehicle tax payments the confirmation receipt that sc gov makes available to you to print after completing your tax payment is only a confirmation of your payment.

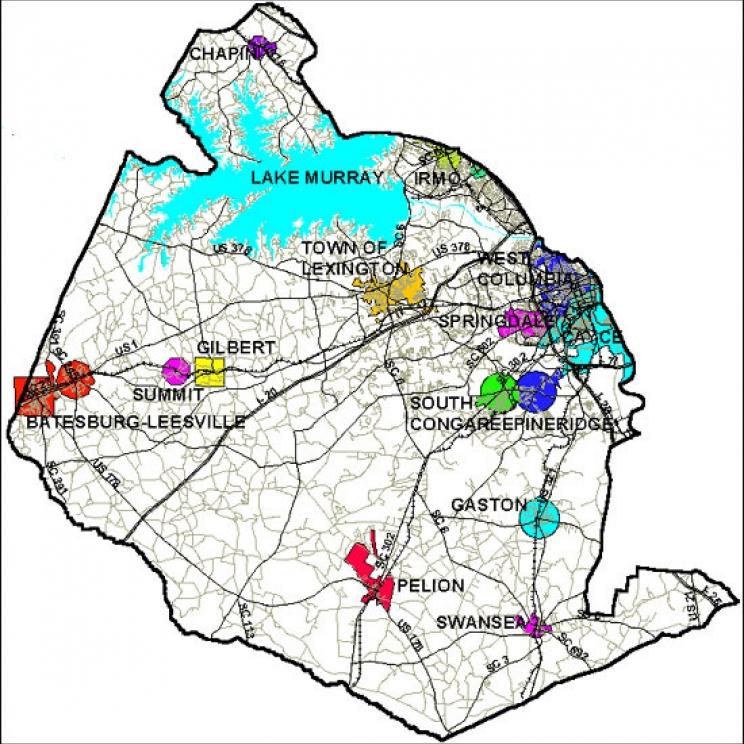

In addition to paying your taxes in person or through the mail we now accept debit credit cards mastercard visa discover and american express and electronic check. The primary duties of the assessor s office are to inventory all real estate parcels maintain the property tax mapping system and maintain property ownership records. Property tax data search this website is a public resource of general information.

Contact the lexington county treasurer s office at 803 785 8217. Any checks returned to the county will result in a reversal of the tax payment. Real property tax notices are mailed to the owner of record october 1st of the given tax year.

Payment is due in full on or before january 15th of the following year. 898 east richmond st suite 103 giddings texas 78942. Lexington county coronavirus covid19 information the lexington county administration building is open for public access monday through friday 9 00 a m.

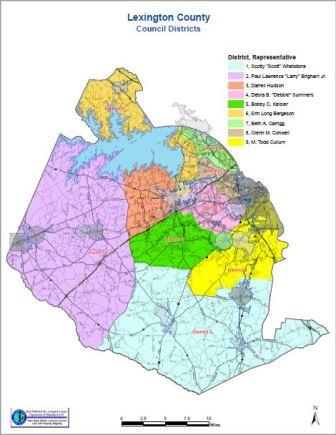

Find a list of telephone numbers for lexington county. All taxes including vehicle and property taxes that are assessed within lexington county must be paid to the lexington county office of the treasurer. It also adds and values new properties and conducts a reassessment of all properties every five years.

The lexington county treasurer s office offers several convenient ways to pay your taxes. The treasurer serves as the tax collector banker investment agent and custodian for all funds received on behalf of lexington county school districts municipalities and special purpose districts. To pay and ask questions about previous tax bills please visit the delinquent tax office at 212 south lake drive in lexington sc.