St Louis County Assessor S Office

Charles county as of the tax date.

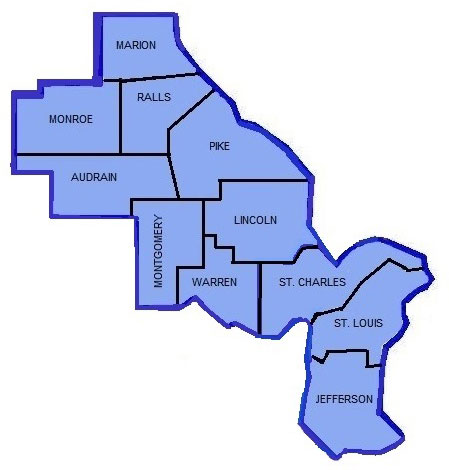

St louis county assessor s office. Louis county courthouse 100 n 5th avenue west 214 duluth mn 55802 218 726 2380. Located in the arrowhead region of northeastern minnesota st. Declare your personal property declare your personal property online by mail or in person by april 1st and avoid a 10 assessment penalty.

It is the assessor s responsibility to ensure each property is equally and uniformly assessed. Louis county including the city of duluth. To do this the department estimates a property s market value and classifies it.

Louis county is the largest county east of the mississippi river. This assures the tax burden is distributed fairly among those responsible for payment. The assessment authority assessor s office is responsible for establishing the fair market value of all property within st.

The assessor s office assesses and records information on all property for the city of st. Assessors can review parcel records with you and explain local sales activity zoning regulations and general market trends. Much of the area has been built on the history of logging and the abundance of iron ore.

Louis county is known for its spectacular natural beauty lakes and trout streams. Property assessment appeals information on how to appeal your property assessment from the assessor s office. The assessor who values and classifies your property should be your first contact if you have questions or want more information.

Tax waiver statement of non assessment how to obtain a statement of non assessment tax waiver.